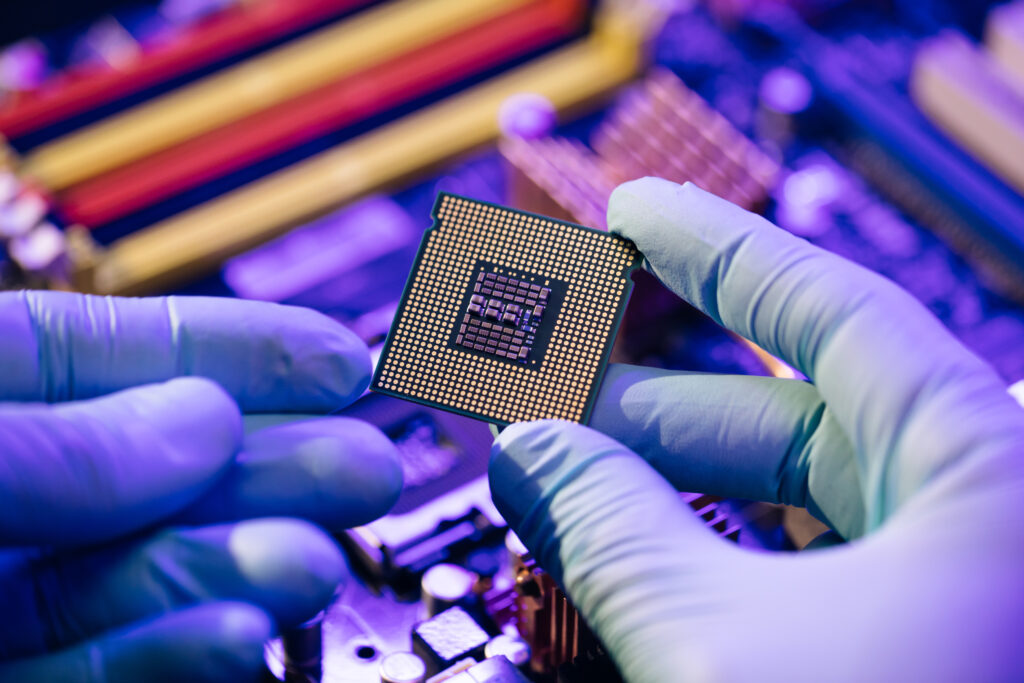

In January of 2021, Congress passed the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act. This legislation, enacted as part of the National Defense Authorization Act (NDAA) for Fiscal Year 2021, authorized a series of programs to promote the research, development, and fabrication of semiconductors within the United States. 17 months later, the bipartisan CHIPS and Science Act of 2022 was signed into law. Specifically, in the publicly released fact sheet which outlines the law, the purpose of the CHIPS and Science Act is to strengthen American manufacturing, supply chains, and national security, and invest in research and development, science and technology, and the workforce of the future to keep the United States the leader in the industries of tomorrow, including nanotechnology, clean energy, quantum computing, and artificial intelligence. The CHIPS and Science Act makes the smart investments so that Americans can compete in and win the future.

Since the 1990s, when the term “fabless” was the rage, the center of semiconductor production has been Asia. Contract fabricators such as Taiwan Semiconductor Manufacturing Corp (TSMC) have been building the chips that drive the rapidly expanding electronic content in all of today’s products. While the semiconductor was invented in the United States, where once as much of 40% of the world’s semiconductor production occurred, the global semiconductor production contribution has diminished to less than 12%. Creating capacity to capture the next wave of market share won’t happen overnight because the advanced fabrication process knowledge gained from shrinking geometries, new power consumption approaches, programmable logic and systems requirements, let alone the advancements in substrate technology are just not transferable over Zoom, cloud storage being shared, or resource recruitment. It is going to require a longer term commitment and plan to expand the full ecosystem of a semiconductor within each greenfield development – from the construction of the fabrication facility, to the design and build of advanced testing equipment, to the manufacturing of the advanced parts required on the testing equipment (See IMD’s article in February 2023 that highlights how 3D Systems Application Innovation Group achieves these advances with semiconductor companies, “Driving Additive Manufacturing Benefits”) to the packaging and assembly equipment, to the operators and clean room requirements, to the computing infrastructure which creates the software that is loaded on the semiconductor.

In 2022, semiconductor sales worldwide were $580 billion. According to IBIS World’s website, the United States’ semiconductor and circuit manufacturing industry in 2022 represented approximately $64.5 billion. Further it is expected to contract to $61.5 billion in 2023. The competition for global market share is only going to increase. The EU has an ambitious goal of producing 20% of the world’s semiconductors by 2030. The European Commission announced a plan, called the EU Chips Act, in 2022 that anticipates around €43 billion going toward the semiconductor industry on the continent, including research and production.

Similarly, China’s domestic semiconductor industry received another boost in January 2022, when the State Council published the 14th Five Year Plan on the Digital Economy to enhance basic research capabilities in strategic sectors, improve self-sufficiency, and strengthen supply chain security in key industries. Technology is a core focus of the plan, with several chapters dedicated to describing how China’s leaders hope to transform the country into an innovation powerhouse. The semiconductor industry—particularly the integrated circuits (IC) industry—is a core component of this effort. Under the plan, as first reported by Reuters, China will invest 1trn Yuan, or some $143bn, in its chip industry over a five-year period with a focus on advanced manufacturing

The CHIPS and Science Act directs $280 billion in spending over the next ten years. The majority—$200 billion—is for STEM, R&D, and workforce and economic development. Those funds are being authorized through the National Science Foundation, US Department of Energy, and US Department of Commerce. Around $52 billion is for semiconductor manufacturing, R&D, and workforce development, with another $24 billion worth of tax credits for CHIPS advanced manufacturing programs. There is $3 billion slated for programs aimed at leading-edge technology and wireless supply chains.

Specifically, The U.S. Department of Commerce has been tasked to oversee the $50 billion CHIPS for America Fund. This provides $39 billion in appropriated funds for a semiconductor manufacturing incentives program over 5 years and $11 billion in appropriated funds over 5 years for R&D and workforce measures. These measures complement the Treasury’s 25% semiconductor manufacturing investment tax credit which has an estimated cost of $24 billion.

Industry 4.0 is driven in part by the Internet of Things – and the ubiquitous expansion of the “edge” of computing. It is possible for every item to have a voice in IoT. As we think about the IoT as being the infrastructure that connects these items or products or devices, we must also think about the “edge” functionality and how its increasing demand will continue to drive more electronics and semiconductor content. Both the number and type of connections are growing exponentially, as well as the number and types of devices.

The CHIPS and Science Act is a good start, and there are several ways your business may benefit from investments in advanced manufacturing and Industry 4.0 workforce development. In early February, the Department of Commerce released this information through the National Institute of Standards and Technology, entitled “Chips Incentives” and accessible at www.nist.gov/news-events/news/2023/02/news-chips-incentives-and-rd

CHIPS Incentives

CHIPS Incentives

Later this month, the Department of Commerce plans to announce more details regarding funding opportunities and application processes.

- In late February, the Department plans to release a Notice of Funding Opportunity for commercial leading-edge, current, and mature node fabrication facilities. This includes both “front-end” semiconductor manufacturers and “back-end” packaging facilities.

- In late spring, the Department plans to release another funding announcement focused on material suppliers and equipment manufacturers.

- In early fall, the Department plans to announce a funding opportunity to support the construction of semiconductor R&D facilities that will further strengthen the U.S. semiconductor manufacturing ecosystem.

- These announcements will contain detailed guidance, processes, and timelines for organizations to apply for CHIPS incentives.

The U.S. must move quickly to build out both leading-edge facilities and the current and mature node facilities that are critical to our economic and national security. While the first funding opportunity is directed toward chipmakers, we know the broader semiconductor supply chain and R&D efforts are essential to creating a competitive ecosystem for semiconductor manufacturing.

Once the first funding opportunity is announced, everyone will be encouraged to provide their feedback. The Department of Commerce will offer all companies in the semiconductor supply chain the chance to submit a brief statement of interest. This will enable them to communicate their expected interest in CHIPS funding and share their initial project visions with the department.

The National Science Foundation has an increased budget to $81 billion which has been appropriated by the CHIPS and Science Act. Within this amount, and formally codified into law is Technology, Innovation and Partnerships which created a directorate that authorizes $20 billion for its initiatives over FY 2023–2027. This new NSF directorate creates breakthrough technologies; meets societal and economic needs; leads to new, high-wage jobs; and empowers all Americans to participate in the U.S. research and innovation enterprise. TIP is a unique opportunity that engages the nation’s diverse talent in strengthening and scaling the use-inspired and translational research that will drive tomorrow’s technologies and solutions. The Regional Innovation Engines program (or NSF Engines), which is a piece of this directorate, supports the establishment of translation accelerators and test beds, invests in workforce development and training, and invests in programs to provide entrepreneurial training. Specific objectives of the NSF Engines are to:

- Advance critical technologies

- Address national and societal challenges

- Foster partnerships across industry, academia, government, nonprofits, civil society, and communities of practice

- Promote and stimulate economic growth and job creation

- Spur regional innovation and talent

NSF funding and oversight will provide “fuel” to these engines. How industry gets engaged to prime the pump and get the engines operating at top output could be highlighted in the January 26 press release from NSF in which a cross-sector partnership with Ericsson, IBM, Intel, and Samsung to support the design of the next generation of semiconductors as part of its Future of Semiconductors (FuSe) initiative was announced. The press release goes on to say “through this partnership activity, NSF will team with Ericsson, IBM, Intel, and Samsung to invest in projects that cultivate a broad coalition of science and engineering researchers to pursue holistic, “co-design” approaches. By intentionally supporting researchers who are integrating materials, devices, architectures, systems, and applications, new semiconductor technology is designed and developed in an integrated way. Co-design approaches simultaneously consider the device/system performance, manufacturability, recyclability, and impact on the environment.” In other words, it isn’t just higher institutions that can work with the NSF in partnership.

Other funds have been earmarked for commercializing innovative ideas or completing practical research within various topic areas. As an example of one of the programs within TIP, Enabling Partnerships to Increase Innovation Capacity (EPIIC) supports the growth of inclusive innovation ecosystems through capacity-building efforts at institutions of higher education with limited research capacity — preparing these institutions to participate in NSF Regional Innovation Engines at a future time. The program aims to broaden participation in innovation ecosystems that advance emerging technologies (e.g., advanced manufacturing, advanced wireless, artificial intelligence, biotechnology, quantum information science, semiconductors and microelectronics) by supporting capacity-building efforts at institutions of higher education (IHEs) interested in growing external partnerships. There are 50 awards planned, of up to $400,000 each. Dates for proposal submission are fast approaching.

What does it all mean for Industry 4.0 and the advanced manufacturing workforce? It means the United States has made a serious commitment to participate in reducing the manufacturing labor shortage that exists today, and to changing the imbalance in semiconductor trade. Businesses which have any link to the semiconductor industry must take note – and plan on a reversal of the skills scarcity and supply shortages to occur on a graduated, intentional timeline, ultimately leading to more jobs and the potential for reshoring semiconductor business. Smarter manufacturing will be the result, says Jason Bergstrom, the Go-to-Market leader for Deloitte’s Smart Manufacturing portfolio, The Smart Factory @ Wichita, and principal at Deloitte Consulting LLP.

What does it all mean for Industry 4.0 and the advanced manufacturing workforce? It means the United States has made a serious commitment to participate in reducing the manufacturing labor shortage that exists today, and to changing the imbalance in semiconductor trade. Businesses which have any link to the semiconductor industry must take note – and plan on a reversal of the skills scarcity and supply shortages to occur on a graduated, intentional timeline, ultimately leading to more jobs and the potential for reshoring semiconductor business. Smarter manufacturing will be the result, says Jason Bergstrom, the Go-to-Market leader for Deloitte’s Smart Manufacturing portfolio, The Smart Factory @ Wichita, and principal at Deloitte Consulting LLP.

“We have seen the semiconductor shortage impact many of our clients across industries. Even if it’s not part of their product, it’s part of their equipment to manufacture the product or other pieces of their operation.

“As a result, we see clients reevaluating the physical location of their operations as this and other shortages make the risk of locating supply far away very apparent. Reshoring – or bringing back domestic production – and nearshoring – establishing new production domestically that was once international – is on the rise in an effort to bring the supply closer to the demand. Industry players in medical technology, batteries, and semiconductors are leading the way with this trend, potentially influenced, at least in part, by government policies and investments from the U.S. in legislation such as the CHIPS Act. This means we’re talking to clients about greenfield/new builds for smart manufacturing facilities, starting from the ground up to create a true Industry 4.0 environment.

“The benefits of a completely new, smart operation also mean that organisations will be able to better predict parts shortages and other supply-chain related issues so that organizations can quickly pivot for less disruption to customers.” [Editor’s Note: quote first published in Manufacturing Digital].

The chips are on the table for the semiconductor ecosystem. It is up to the industry to get in the game and leverage these resources to continue the momentum towards once again setting the bar for semiconductor and electronic manufacturing. To get more information on the CHIPS and Science Act, and how it is setup to impact the Industry 4.0 Workforce, go to CHIPS.gov. If you are considering applying to a CHIPS for America funding opportunity, take the first step by obtaining a SAM.gov registration and Unique Entity Identifier (UEI) number as soon as possible.