It’s no secret that many government-funded technologies initially developed for the aerospace and defense sectors eventually become available to civilian industries. But what you might not know is that, in some cases, the U.S. Government contractually obligates defense contractors to commit to commercializing their innovations. In fact, that commitment is included in the standard contracts for certain government-funded programs, such as the U.S. Air Force’s Small Business Innovation Research (SBIR) program.

Bigger Budgets and Greater Risk-Taking

There are two key reasons why the government-funded aerospace and defense sectors have often driven technological innovation. Compared with commercial manufacturers, they’re 1) less cost-focused and 2) less risk-averse. Of course, the government sector is risk-averse, too, but the military has larger budgets, which allow it to more easily mitigate the risks of developing and testing new technology. Moreover, commercial manufacturers often – and quite understandably so – subscribe to the maxim of, “If it ain’t broke, don’t fix it.” Industry leaders might not, therefore, be willing to consider new technology until it has already established a strong track record elsewhere.

Farming out Defense Technology

At robotics company Aerobotix, the same automated painting solutions we’ve developed to coat fighter jets and missiles for the U.S. Air Force and Army is now also being used in commercial manufacturing, most notably for painting agricultural equipment. Just like the Air Force, manufacturers of agricultural equipment have welcomed the benefits of automation, including time and cost savings, and improved product quality.

The commercialization of those robotic painting technologies quickly followed their development for the defense sector, and sometimes even happened simultaneously. But for other defense technologies, it can be a much longer timeline for commercialization. This might be because some technologies remain classified – the U.S. Government doesn’t want to risk them being shared with unfriendly nations – or just because the commercial sector is slow to embrace them.

The use of unmanned systems in warfare was first recorded during World War I and continues to expand in capabilities. Meanwhile, commercial use of automation and robots has also expanded over the past few decades to include manufacturing, healthcare, retail, agriculture and mining, among other industries – and this growth will only accelerate as robots become more sophisticated and affordable.

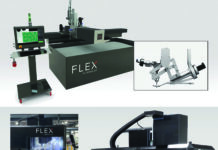

From the Defense Base to your Local Airport

In 2021, the U.S. Air Force took delivery of the first collaborative mobile robot for its maintenance depots. This adaptive radome diagnostic system (ARDS) was a collaboration between Aerobotix and Compass Technology Group (CTG), a provider of cutting-edge radio frequency (RF) materials measurement equipment. It was built for the Warner Robins Air Logistics Complex (WR-ALC) in Georgia and developed under the Air Force’s Small Business Innovation Research (SBIR) program. The ARDS won the top Defense Manufacturing Technology Achievement Award at the 2021 Defense Manufacturing Conference. The ARDS manipulates an advanced microwave mapping probe (AMMP), which uses microwave signals for non-destructive evaluation (NDE) of aircraft radomes to identify defects such as delamination or water ingress. This automated, digitized analysis puts aircraft back into service faster and at less cost. The ARDS project team developed new expert system algorithms specifically for diagnosing radome health and performance, including in high-tempo depot or factory environments.

We know that the commercial aerospace sector is paying close attention to the ARDS as well as other next-generation automated guided vehicles (AGVs) being utilized in the defense industry. But we also know that the commercial sector is more risk-averse and cost-focused than its government-funded counterpart, and for those reasons, the commercial aerospace industry is still likely several years away from starting to use the latest AGVs in earnest. The biggest hurdle that next-generation AGVs must overcome is scalability. With many aerospace and defense clients still taking delivery of their first mobile robot, and with most of these AGVs being custom built, the technology’s production has not yet been scaled and its costs therefore remain relatively high. Those costs can, however, be offset over time by the improved efficiencies that an AGV will achieve for an organization.

In addition to commercial aerospace, the mobile robot technology we developed for Air Force maintenance depots also have other potential commercial maintenance applications. These include wind turbines, boats and any other structures comprised of composite parts that require delamination inspections.

Radar and Satellite Tech Goes Commercial

Radar and Satellite Tech Goes Commercial

Originally developed for military purposes, radar is now used in a variety of commercial applications, such as air traffic control and weather forecasting. Military operation of radar was widespread across many countries during World War II, and the first successful use of radar by the U.S Navy occurred more than 100 years ago. Today, radar applications are used commercially as airlines track passenger flights. In combination with LiDAR, radar is also used by autonomous self-driving vehicles. Additionally, civilians are using radar applications on a daily basis when searching websites and apps to see real-time storm patterns that could be approaching their local area in the next few days, hours or even minutes.

Meanwhile, satellites are another technology that has expanded from military to commercial use over time. In 1957, the Soviet Union famously launched the Sputnik satellite, and a frenzied “space race” between competing countries began. Since then, the Hubble telescope and International Space Station are further examples of how satellite technology has developed to include imaging and research capabilities.

However, the most widespread commercial implementation of satellites is likely the Global Positioning System (GPS). GPS was designed by the Department of Defense in the 1970s, and is still owned by the U.S. Government and today is operated by the Space Force branch of the military.

After the USSR shot down Korean Air Lines Flight 007 in 1983 for accidentally straying into Soviet territory, President Ronald Reagan ordered that GPS be made more broadly available for the public good. Today, anytime the average individual uses, for example, a Maps feature or Waze app on their smartphone, they’re benefitting from the advancements made over the past several decades in satellite and GPS technology. This resource also helps prevent tragic events like Flight 007 from happening again.

Benefits of the Technology Transfer

The process by which the U.S. Government partners with defense contractors has been mutually beneficial to both parties and has developed historically to also include many advantages for commercial industries and the general public. The commercialization of aerospace and defense technology has had a far-reaching positive impact on countless other industries and has further led to the development of additional new technologies, reduction of overall costs and increased safety. Clearly, the technology transfer from the military sector to commercial and civilian segments has broader applications than just those for defense purposes and will continue to be utilized as a driver of innovations to benefit society.

About the Author

Josh Tuttle is a business development manager at Aerobotix, an innovative leader in robotic solutions for the aerospace and defense industries. Headquartered in Huntsville, Alabama, the company specializes in the creation of cutting-edge automated robotic solutions for high-value, high-precision components, aircraft and vehicles.