- Slight contraction or stagnant growth expected for most manufacturing economies worldwide in 2024, but projections of a soft 2024 leading to recovery in 2025 are holding

- China’s growth forecast revised down slightly as economic conditions continue to bite

- Outlook for many territories better than expected for the end of 2025

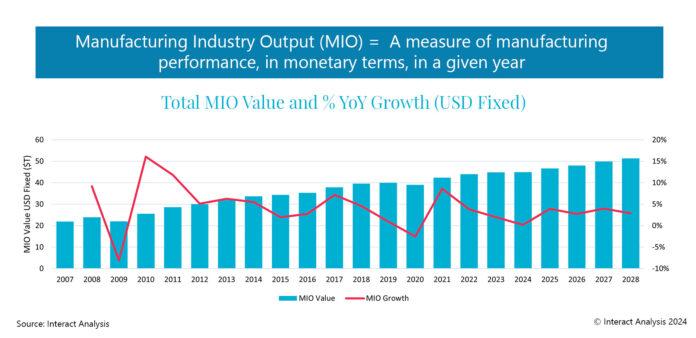

The global manufacturing economy will remain sluggish in 2024 and is forecast to expand by just 0.6% compared with last year. However, it looks set to recover in 2025, the latest data from Interact Analysis reveals. The market intelligence expert explains, except for China, most territories will experience a slight contraction this year, but many will be better off than expected going into 2025.

Although Interact Analysis has lowered growth forecasts for 2025 in its latest Manufacturing Industry Output Tracker (MIO), this is the result of a slightly improved global outlook for the end of 2024, which will in turn see most economies finish the year in a stronger position. A slight dip in the growth rate is anticipated in 2026, but manufacturing output is expected to maintain a relatively steady positive trajectory out to 2028.

Manufacturing output is expected to recover in 2025 and maintain a steady rate through to 2028

No clear signs of where recovery will come from

It is still unclear where the global manufacturing recovery will come from and until there is an upturn it is difficult to judge the potential strength. Despite optimistic signs for other territories, the latest MIO includes a slight downward revision for China compared with the previous edition; from 2.8% to 2.4%. China as ‘the factory of the world’ is responsible for almost half of the total manufacturing market value and any further reductions in the country’s forecast could well lead to a small contraction in the global MIO figure for 2024.

Consumer resilience coupled with inflation and interest rates slowly starting to fall is pushing up spending worldwide and the US manufacturing economy is strengthening. The semiconductor industry has bounced back from a low point in 2023, boosting outlook for parts of South-Asia heavily reliant on the market sector, including Taiwan, Singapore and South Korea. Dwindling order books and the impact of the higher cost of living have constrained global demand, but there are signs of recovery in consumer spending and post-Covid supply chain problems have eased considerably.

However, there are various economic indicators pointing to a more challenging environment for manufacturers. All four major European manufacturing economies are in a downward cycle, and sentiment for the year remains gloomy. Positive signals from the US may well start to manifest in other regions later in the year, but this has yet to be seen.

Conditions remain challenging for machinery market

Although the overall outlook for manufacturing is expected to improve into 2025, the machinery market is in a slightly worse position. There are variations by machinery type, but underlying factors include persistently high interest rates pushing up the price of new machinery and low order intake in the last year affecting current production figures.

Adrian Lloyd, CEO at Interact Analysis, says, “The global outlook for manufacturing output is mixed to say the least. Our projections are holding but there are no clear signs of where recovery will come from and how strong it will be. As a result, we will be watching closely to see how constrained consumer spending in China, a strengthening US economy and global events will affect conditions.

“In the latest edition of our MIO tracker, we have added some details about machinery markets and will cover additional machinery sectors in coming editions. The machinery market appears to be experiencing more challenging conditions than manufacturing overall, as global uncertainty leads to caution around investment in equipment.”

About the Report

In a fast-moving sector with complex correlations, it is critical to understand the state of the market now, where it was, and where it will be. This report quantifies the total value of manufacturing production with deep granularity – for over 102 industries, across 44 countries, and presenting 15 years of historical data – for a complete business cycle, pre-recession to the present day.

We have carefully organized the country data around a common taxonomy to provide easy-to-interrogate, like-for-like comparisons. Credible five-years forecasts round out the view.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth.