- All regions are set to suffer a tough 2024, however, for most, the trough will be mild.

- The semiconductor segment will enjoy a better 2024 compared with 2023.

- The expected CAGR for APAC’s manufacturing segment is 2.9%, followed by the US (2.4%) and Europe (2.4%).

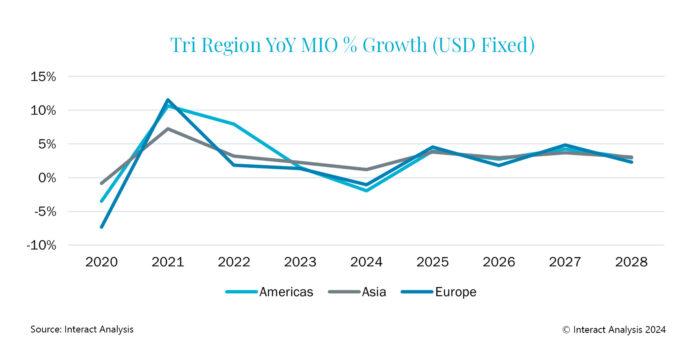

Despite a tough year ahead for most regions and territories in 2024, growth will return in 2025 for many sectors. In line with Interact Analysis’ previous update to its Manufacturing Industry Output (MIO) Tracker, the company’s latest forecasts show the lowest point in the manufacturing cycle for many regions and sectors is expected to occur this year. Despite this, key regions such as the US and Germany will shrink half as much in 2024 as they did at the height of the COVID-19 pandemic. In contrast with most industry sectors, the semiconductor segment is expected to have a much better 2024, following a difficult year in 2023.

One of the most significant adjustments Interact Analysis has made to its long-term outlook is the prediction of slower growth for the machinery segment over the next 5 years due to a weak 2023, a contraction in 2024, and concerns regarding 2025. However, the expected CAGR for APAC manufacturing between 2023 and 2028 is expected to be positive at 2.9%, followed by the US (2.4%) and Europe (2.4%).

2024 is expected to be a negative year for manufacturing in Europe and Americas, China keeps Asia growing, recovery expected in 2025

In the US, the Federal Reserve shows no signs of cutting interest rates yet, suggesting the region will suffer a difficult 2024, with negative growth potentially continuing into 2025. The US economy is expected to shrink by 2.2% in 2024, before bouncing back to 3.8% In 2025, and there does not appear to be a huge demand or supply-side problem, so the downturn is not likely to be as severe as during the pandemic.

In Europe, the economic outlook for 2024 looks just as bleak. Italy is in one of the worst positions, with machinery production expected to shrink by 3.7% in 2024 and the manufacturing sector to contract by 1.5%. As a result of falling wage increases and decreasing employment levels, the Italian economy is set to struggle. Interact Analysis is also predicting a manufacturing decline of -0.8% for Germany in 2024 and -1.3% for France. The UK is predicted to continue struggling while it navigates the challenges associated with a post-Brexit economy. Interact Analysis’ prediction for the UK’s manufacturing sector outlook overall in 2024 is -0.4% and -3.3% for machinery.

Adrian Lloyd, CEO at Interact Analysis comments, “While everything seems so doom and gloom, we are seeing positive order books for semiconductor machinery. This sector is in an odd position currently; as demand for semiconductor machinery increases, the production of semiconductors themselves has all but collapsed. North America’s order growth for semiconductor machinery has reached over 50% – likely due to the CHIPS and Inflation Reduction Act – while Europe and Taiwan also continue to place orders.

“Although 2024 will be a tough year for the global manufacturing industry, our predictions suggest that the severity of the growth trough will be mild for most regions.”

About the Report:

In a fast-moving sector with complex correlations, it is critical to understand the state of the market now, where it was, and where it will be. This report quantifies the total value of manufacturing production with deep granularity – for over 35 industries, across 44 countries, and presenting 15 years of historical data – for a complete business cycle, pre-recession to the present day.

We have carefully organised the country data around a common taxonomy to provide easy-to-interrogate, like-for-like comparisons. Credible five-years forecasts round out the view.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth.