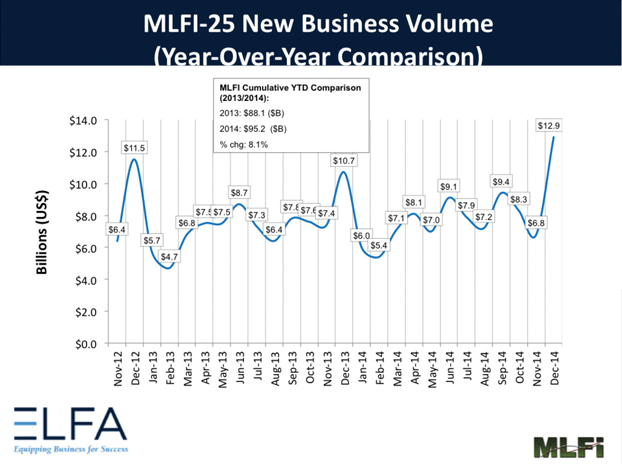

December New Business Volume Up 20 Percent Year-over-year, Up 90 Percent Month-to-month, Up 8 Percent Year-end

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $903 billion equipment finance sector, showed their overall new business volume for December was $12.9 billion, up 20 percent from new business volume in December 2013. In a typical end-of-year spike, their new business volume was up 90 percent from November volume of $6.8 billion. Cumulative new business volume for 2014 rose 8 percent over 2013.

Receivables over 30 days were unchanged from the previous month and from the same period in 2013 at 1 percent. Charge-offs were unchanged for the ninth consecutive month at an all-time low of 0.2 percent.

Credit approvals totaled 78.6 percent in December, a slight decrease from 79.1 percent the previous month. Total headcount for equipment finance companies was up 0.5 percent year over year.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) for January is 66.1, an increase from the December index of 63.4 and the highest level in the last three years.

ELFA President and CEO William G. Sutton, CAE, said: “Despite a very volatile Q4 equities market, the U.S. economy ended the year in a strong position, evidenced by lower unemployment, continued healing in the housing market, gas prices that seem to be declining almost daily, and robust consumer spending. Against this backdrop, C&I lending picked up as commercial businesses made significant investments in plant and equipment. Despite the typical end-of-year seasonal spike, December’s MLFI-25 statistics enter record territory: the 20 percent increase in year-over-year new business volume was one of the largest December increases in the history of the MLFI-25. Add to this healthy credit markets and the equipment finance industry appears poised for the breakout performance industry observers have been waiting for. We hope that this momentum will carry forward into 2015.”

Bill Wavro, President, Dell Financial Services, said, “The rise in new business volume for 2014 reflects what we hear in conversations with Dell customers and channel partners every day. Whether an entrepreneur saving cash for key business investments or a large enterprise looking to lower total cost of ownership, customers are seeing how financing large equipment and technology transactions delivers a real bottom-line and operational benefit for their businesses.”

About the ELFA’s MLFI-25

The MLFI-25 is the only index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 8 a.m. Eastern time from Washington, D.C., each month on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. See below for the latest MLFI-25, including methodology and participants, or click HERE.

MLFI-25 Methodology

The ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.

ELFA MLFI-25 Participants

BancorpSouth Equipment Finance

Bank of America

Bank of the West

BB&T Bank

BMO Harris Equipment Finance

Canon Financial Services

Caterpillar Financial Services

CIT

DLL

Dell Financial Services

Direct Capital Corporation

EverBank Commercial Finance

Fifth Third Equipment Finance

First American Equipment Finance, a City National Bank Company

GreatAmerica Financial Services

Hitachi Credit America

HP Financial Services

Huntington Equipment Finance

John Deere Financial

Key Equipment Finance

LEAF Commercial Capital

M&T Bank

Marlin Leasing

Merchants Capital

PNC Equipment Finance

RBS Asset Finance

SG Equipment Finance

Siemens Financial Services

Stearns Bank

Suntrust

Susquehanna Commercial Finance

TCF Equipment Finance

US Bancorp Equipment Finance

Verizon Capital

Volvo Financial Services

Wells Fargo Equipment Finance

About ELFA:

The Equipment Leasing and Finance Association (ELFA) is the trade association that represents companies in the $903 billion equipment finance sector, which includes financial services companies and manufacturers engaged in financing capital goods. ELFA members are the driving force behind the growth in the commercial equipment finance market and contribute to capital formation in the U.S. and abroad. Its 580 members include independent and captive leasing and finance companies, banks, financial services corporations, broker/packagers and investment banks, as well as manufacturers and service providers.

For more information, please visit:

www.elfaonline.org

ELFA is the premier source for statistics and analyses concerning the equipment finance sector.

For more information, please visit:

www.elfaonline.org/Research

The Equipment Leasing & Finance Foundation is the non-profit affiliate to the Equipment Leasing and Finance Association, providing future-focused research to the equipment finance industry.

For more information, please visit:

www.leasefoundation.org