- The global precision gearbox & geared motors market is forecast to grow by 10.2% in 2025, with sustained long-term growth on the horizon.

- Global economic challenges led to an earlier than predicted market slowdown in 2023-24.

- The mobile robot segment presents strong growth for precision geared products.

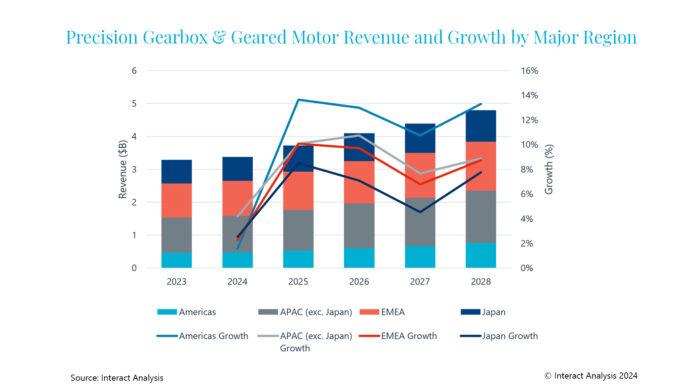

The landscape of the global precision gearbox and geared motor market is undergoing significant transformation and is expected to grow by over 10% in 2025, as it recovers from an earlier than anticipated dip in 2023 and 2024. According to the latest data from market intelligence specialist Interact Analysis, strong demand will generate a compound annual growth rate (CAGR) of 7.9% – with the market increasing from $3.29 billion to $4.8 billion – between 2023 and 2028.

The precision gearbox and geared motor market has not been immune to the broader economic challenges of the last two years. The slowdown for the market made an early appearance in 2023 and 2024 due to global economic and socio-economic unrest, including inflation and high interest rates.

The Americas region is expected to show the highest rate of growth over the period from 2023 to 2028, with a CAGR of 10.4%, while the APAC region, excluding Japan, is forecast to be the fastest-growing market in 2024. This latter growth is attributed to the region’s manufacturing sector and the rise of local precision gearbox suppliers catering to the burgeoning number of collaborative robot manufacturers in China.

Strong revenue growth is forecast in each region, particularly the Americas, between 2023-2028

Demand for automation at the heart of growth

At the heart of the precision gearboxes market’s resilience is innovation. The emergence of new industries, such as battery manufacturing and humanoid robots, will present fresh opportunities for growth.

The industry projected to see the strongest growth in demand during the forecast period is mobile robots (CAGR of 45.9%), where precision gearboxes are commonly used in the drivetrain of the robot; and the second largest predicted increase in demand is in battery manufacturing (CAGR of 13%). With over 150,000 mobile robots shipped globally in 2023, the sector is experiencing substantial growth due to increasing demand for more automated fulfilment and warehouse automation resulting from the continuing trend towards e-commerce.

Despite strong growth in mobile robotics, the industrial and collaborative robot markets remain the largest consumers of precision gearboxes worldwide. Regional variation exists, but overall, these markets experienced a slowdown in market growth in 2023, but demand is expected to pick-up again worldwide fairly quickly. In 2023, the market value of gearboxes sold into the industrial and collaborative robots’ segment was just over $1 billion, making up 31% of the total precision gearbox market. By 2028, this segment is expected to grow to $1.33 billion.

Jonathan Sparkes, Senior Research Analyst at Interact Analysis, comments: “Beyond 2024, a rebound is predicted as the general outlook for the robotics market, and manufacturing and machinery production begins to improve, with interest rates lowering and more optimism surrounding investment in automation continuing.”

About the Report:

A report providing highly-detailed insight and analysis into the precision gearbox & geared motor market.

The report is built through extensive primary research and supplier reporting and utilizes data from Interact Analysis’ “Manufacturing Industry Output Tracker (MIO)” – highly regarded for its industry forecasts by country, which will inform the forecasts for precision gear devices at a country-level. Interact Analysis’ Industrial and Collaborative Robot reports also supported the forecasts for the precision gearbox and geared motors report.

About Interact Analysis

With over 200 years of combined experience, Interact Analysis is the market intelligence authority for global supply chain automation. Our research covers the entire automation value chain – from the technology used to automate factory production, through inventory storage and distribution channels, to the transportation of the finished goods. The world’s leading companies trust us to surface robust insights and opportunities for technology-driven growth.