The product lifecycle for original equipment manufacturers (OEMs) is not unlike that of a software-as-a-service (SaaS) business. While many companies strive to commercialize fewer but bigger solutions, product innovation often comes in the form of incremental, but important, equipment or feature updates tailored to specific industries and customers’ operating conditions.

This format matches buyer preferences. Capital budgets needed for large pieces of new equipment are limited and require the approval of many stakeholders. It is often easier to demonstrate ROI for smaller purchases or upgrades, and the sign-off process is streamlined. Low risk, high reward.

Win-win for everyone, right? It’s not quite that simple.

One would think that with a product strategy predicated on several variations of parts and equipment engineered for certain industries and operating conditions, OEMs and distributors would employ teams of specialized and experienced sales and marketing professionals that know the ins and outs of every product variation for each industry they sell to.

Buyers look to sellers as the expert to tell them which solution, from a line of products that may look the same to the untrained eye, will best support their operations. For example, in the case of a plant manager in the market for a new filtration system, the seller is their resource to explain exactly which SKU they need based on the factory’s water conditions, production requirements, and many other factors. Specialized knowledge is needed, but it’s not always easy to come by.

In the last couple of years, a few market factors have made it increasingly challenging for OEMs and distributors to thrive in this selling environment:

- Workplace gaps – the manufacturing industry was hit especially hard during the Great Recession of the late 2000s and early 2010s. While the employment rate has improved, the industry has not fully recouped the 1 million manufacturing jobs lost during the recession. In tandem, baby boomers that made up many manufacturing positions, are retiring daily – less than 40 percent of the 76 million baby boomers are expected to still be working by 2022. This has left a personnel and knowledge gap that didn’t exist in the 1970s when a manufacturing career was more sought after.

- Data overload – the manufacturing industry is deep in the throes of Industry 4.0 thanks to the advent of automation and the internet of things (IoT), and it offers a level of business intelligence and efficiency that was previously unimaginable. With this, has come a deluge of data that manufacturers are still learning how to wade through. So much so, that they’re finding it difficult to properly leverage data to better market and sell their own products and solution offerings, thus missing opportunities on their doorstep that they could be using to get ahead.

- Complex sales and marketing structures – it’s not uncommon for a manufacturer to have multiple marketing teams aligned to various business units, with corresponding regional sales teams located throughout the country or world. Not only are sales and marketing teams physically dispersed, but their sales channels can vary and cycles are often long and complex, with some teams selling directly to customers while others sell through a distributor. This reality leaves manufacturers vulnerable to the high possibility that messaging, value propositions, product updates and other communication is diluted or inaccurate before it even reaches customers or prospects.

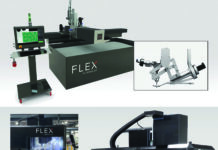

Faced with fewer skilled workers, an excess of data, and challenging selling formats, new sales, and marketing tools are making their way to the fore to help manufacturers fill in the gaps of their sales and marketing strategies. For example, dynamic, rule-based content management tools allow marketing to push messaging updates and product nuances directly to salespeople in the field based on where they are and who they’re selling to. This allows manufacturers to maximize sales teams by delivering up-to-date, accurate sales content and information on specific operating conditions right to their fingertips. Less experienced salespeople can be the industry experts that buyers expect them to be, even when addressing product differences.

Unlike the flood of data coming from IoT devices that is difficult to locate, let along leverage, next-generation content management tools also help manufacturers begin to make use of data in a very specific and concentrated way. As opposed to the traditional “go with your gut” approach of making educated guesses on the kinds of content and information that will compel one plant manager, because it hooked another, engagement analytics allow manufacturers to prove the effectiveness of sales and marketing content sent from a digital tool based on open rate, time spent on content, and other trends. The number of resources spent on content creation, the effectiveness of certain messages, and when and how sales should follow up, can all be refined accordingly, accelerating the sales cycle.

As with any industry, whether B2B or B2C, manufacturing customers expect transparency and personalization. The message and “pitch” must be explicitly for them and their challenges, whether they’re buying a one-off part or an entire piece of machinery. The next wave of sales and marketing technology is helping manufacturing sellers and marketers become more agile in how they go-to-market, regardless of industry pressures.