According to the IBISWorld Industry Report, the metal pipe and tube manufacturing industry in the US is expected to decline by 4.4% in 2023. The industry’s revenue is expected to reach $17.4 billion in 2023, down from $18.2 billion in 2022, and below the $18.0 billion in 2018. The decline in the metal pipe and tube manufacturing industry is being driven by a number of factors, including the increasing popularity of plastic pipe, the rising cost of metal, and the growing demand for sustainable materials.

- In 2022, the global metal pipe industry generated $123.98 billion in revenue.

- In 2023, the global metal pipe industry is expected to generate $119.74 billion in revenue.

- This represents a decline of 3.3% in revenue from 2022 to 2023.

- The decline in revenue is expected to continue in the future, as plastic pipe becomes more popular and the cost of metal continues to rise.

- Metal pipe is not a sustainable material as it requires significant energy to produce.

Growth of Plastics Pipe

HDPE pipe has been growing in popularity in recent years due to its many advantages over traditional metal pipe. In 2020, the global HDPE pipe market was valued at $36.9 billion and is expected to reach $52.1 billion by 2027. The growth of the HDPE pipe market is being driven by a number of factors, including:

- The increasing demand for expansion and replacement of aging water and wastewater infrastructure

- The need for corrosion-resistant pipe

- The ease of installation of HDPE pipe

- The cost-effectiveness of HDPE pipe

As a replacement for metal pipe opportunities, HDPE pipe has a number of advantages including:

- Corrosion resistance: HDPE is resistant to corrosion from a wide range of chemicals, including acids, bases, and salt, as well as soils and wastewater byproducts. This soil and wastewater byproduct resistance makes it ideal for use in applications such as water and wastewater treatment.

- Flexibility: HDPE is a flexible material, which makes it easy to install in a variety of applications. It can be bent and shaped to fit around obstacles, which can save time and money on installation. HDPE is a more desired product for trenchless installation such as horizontal directional drilling (HDD).

- Durability: HDPE is an extremely tough material that can withstand a wide range of environmental conditions and rigorous operating conditions of force mains. It is not affected by extreme temperature, or UV radiation.

- Cost-effectiveness: HDPE pipe is often more cost-effective than traditional metal pipe. This is due to the fact that HDPE is a lighter material, which means it is easier to transport and install. HDPE is also less expensive to manufacture than metal pipe.

Municipalities and High Density Polyethylene (HDPE)

Population increase in many metropolitan areas is stressing older infrastructure. In some cases this potable water and wastewater infrastructure is over 100 years old. As a result, many municipalities find themselves in a position of not just need but indeed requirement to change. HDPE demand is being driven in large part by these municipalities, especially as more of these factors emerge:

- Rapid urbanization: As we previously mentioned, urbanization is a major driver of demand for municipal HDPE pipe. As cities grow, they need to invest in new infrastructure, including water and sewer systems.

- Increased infrastructure spending: Governments around the world are investing in upgrading aging infrastructure, including water and sewer systems. This is driving demand for HDPE pipe, which is a popular material for these applications.

- Demand for sustainable materials: There is a growing demand for sustainable materials, and HDPE is a sustainable material. It is made from polyethylene, which is a renewable resource.

- Improved performance: HDPE pipe has improved performance over the years. It is now more durable and corrosion-resistant than ever before.

- Cost-effectiveness: HDPE pipe is often more cost-effective than other materials, such as metal pipe.

As a result of these factors, the municipal HDPE demand is expected to continue to increase in the future. According to a report by MarketsandMarkets, the global market for municipal HDPE pipe is expected to grow from $12.8 billion in 2022 to $21.2 billion by 2027. This represents a compound annual growth rate (CAGR) of 7.6% from 2022 to 2027.

The report also projects that the Asia Pacific region will be the largest market for municipal HDPE pipe, followed by North America and Europe.

Well Positioned to Win

Well Positioned to Win

There are generally two types of HDPE pipe manufacturers in North America – those companies that are owned or controlled by resin manufacturers, and those that are free to choose the resin they want to use. Examples of the former include WL Plastics owned by Ineos, Performance Pipe owned by Chevron Phillips, and JM Eagle with family connections to Formosa, Agru, and others. “Converters,” as pipe manufacturers are generally referred, because they convert resin to pipe, include two category manufacturers which are 1) Solid Wall – pressure pipe (water and wastewater) and non pressure pipe (conduit for data, electrical), and 2) Corrugated – mainly storm water pipe which operated under gravity flow. Pipeline Plastics, based in Westlake, Texas, is the largest Solid Wall converter in the United States not owned by a resin company.

Mike Leathers, the President and CEO of Pipeline Plastics, believes they are best positioned to take advantage of the growth opportunity in HDPE. By 2024, Pipeline will have capacity for production of nearly half billion (480,000k) lbs across 4 plants. This is based on a growth plan to utilize existing available space for new lines and adding buildings. Not only are they filling capacity, but they are doing so with a tendency toward sustainability.

“We are one of the better companies from a sustainability perspective. With energy efficient equipment, safety culture, recycling and reuse helps keep our “footprints” [carbon] low. Lines that have really high output capacities assist these efficiencies.”

Jordan Latham, Vice-President of Manufacturing, also provided this insight on the company when asked about advanced manufacturing. “Our industry, as well as Pipeline Plastics, has transitioned into the 21st century with an enormous amount of automated processes to help ensure constant supply to the customer of quality products and to support company growth. 10 to 15 years ago, all of our process equipment still had analog control systems. You would manually calculate pounds per hour (PPH) because an extruder is just a volumetric pumping machine that is not entirely controlled.

Now with a push of a button, our gravimetric system and operating control systems allow us to control every aspect of our product precisely. With our inline wall monitor system, we can give customers the reassurance that the product is perfect. This, coupled with our automatic coiling system, helps to ensure that we will continue to make pipe even with the constraints in the staffing market now.

In the future, our facilities will become automated even further to overcome the shortage of skilled employees in the market. We have already started down this path for our 2023 and 2024 Capex.”

Leathers told us Pipeline provides water and wastewater pipe to municipalities, mining, agriculture, irrigation, industrial, and energy sector as well as pipe for natural gas distribution (NGD – yellow pipe). “Our pipe is a versatile product serving a diversified industry base – which really helps in balancing our business against the ups and downs of different industry segments.” Mike went on to let me know that they were providing pipe for a couple of semiconductor and battery fabs in Arizona and North Caroline, respectively. He was keenly aware of the CHIPS Act that we discussed in our March edition of IMD, and the positive impact to the semiconductor industry of the funding which has been made available by Congress to the semiconductor ecosystem. Further tailwinds for both oil & gas as well as municipal water funding are beginning.

Manufacturing HDPE Pipe

Manufacturing HDPE Pipe

I asked for an overview of the manufacturing process, as my experience with plastics was limited to some injection molding lines at a facility in Erie, PA where large presses forced resin through precision dies to create enclosures and triggers for spray bottles. The presses were big and the dies were super heavy – causing change over challenges. I figured with a pipe it would be something close – but was proven wrong out of the gate.

“Is it pressure or temperature that melts the resin?” I asked. “Temp mainly but a combination of factors to provide highest outputs and quality” said Leathers. Ok, time to sit back and learn was my reaction.

The resin arrives via rail to the manufacturing locations, and is pumped via air into the silos. White pellets of virgin ethane-based resin (ethane, ethylene, other by-products of fossil fuels – so consuming waste from other processes) and Pipeline Plastics uses resin from US-based providers. It is considered a 5th generation resin, with a formulation designation of PE4710 which is the latest formulation. This resin is generally considered to produce a higher performance pipe, and provides for improved benefits along with great margins of safety against unforeseen operating challenges. The mix is called salt and pepper because the virgin white resin pellets are mixed with a 6% content of carbon black concentrate. My initial thought was that carbon black provided some type of structural integrity, but that was incorrect. It is primarily for UV radiation (sunlight) protection so if the pipe is in the sun it isn’t going to degrade the material integrity, after even decades of direct exposure.

Air moves the resin pellets from the silos to the line destinations, where the pellets are fed through blender and dryer system, and eventually through a gravimetric feed to a feed throat The feed throat delivers the material to screws which moves it through barrels that have different heat zones, which incrementally heat the material to keep it flowing. It then hits the die and pin and comes out in the shape of a pipe. A vacuum tank and puller begin the pipe down the line, where the pipe will encounter spray tanks and annealing zones.

The secret to success here is the measurement of variables and the reaction to the variables – how fast can the material heat up, how fast can the pipe be moved, how fast can it be cooled down. There is a closed loop feedback system to the puller and extruder to manage speed of pull and quantity of material being introduced. The typical approach is to keep the screw speed (extruder) consistent and vary the speed of pull based on the melt index – whether it is melting faster or slower than anticipated to hold wall thickness.

Removing Heat

Getting rid of the heat in the extruded pipe is the next extrusion challenge. Spray tanks are used on the lines. These spray tanks are different from the “older” extruded approach where the pipes would be submerged under water to be cooled. With technology, it was determined that water was acting more like an insulator in this situation – which limited thermal dissipation. Now the approach is basically to spray or mist the pipe rather than submerge the pipe into water. Water pumping and chiller equipment cool the water and enable water recycling for the line.

While water is being sprayed on the outside, cold air is being forced through the middle of the pipe. This dual cooling approach allows the pipe to be cooled from the inside and the outside.

Annealing zones between the spray tanks allow heat to radiate to the outside of the pipe to reduce any residual stresses caused by this differential cooling.

Nothing is Wasted

The continuous pipe run then moves through an automated saw on the line to cut the delivery lengths. For instance on large pipes, it is usually delivered in 50ft sticks. However, the delivery method depends on the pipe size and can be in a bundle of sticks, or in a coil depending on pipe dimensional characteristics. Sometimes this can be in the form of 2500 ft or 5000 ft coil of pipe. “We can make a mile of pipe as a single piece on 8” and lower,” said Leathers.

This entire process happens over a 300 ft section with auto saw cuts, then auto load to tables occurring as the last work step inside the four walls. A manual forklift moves the staged pipe to the yard and quality control checks and processes are completed.

Throughout the manufacturing process, any startup pipe or test pipe used for testing pressure performance, testing density, or testing mixtures of additives, is simply sent back to a grinder to be ground back into the resin pellets and used again.

To measure whether tolerances have been met for wall thicknesses, SONAR is used. Inoex provides the SONAR (Warp System) for measurements. The WARP system provides a 360 degree, continuous measurement of the OD and pipe walls to assure the pipe is uniform and complies with all dimensional requirements.

Changeovers and Interchangeable Lines

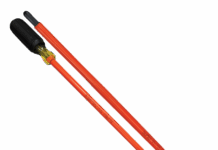

Pipeline Plastics has 4 plant locations with multiple lines at each location. Generally the production lines can be configured to do anything from ½” CTS going 80 fpm to 65.5”. Various lines can do changeovers to perform different sizes within a line group, for example. 1”-8”, 8”-16”, 12” – 24”, 24”-36”, then large lines up to 65”, which in aggregate provides the market with one of the largest size range options available. There is line redundancy for highest volume HDPE and NGD (natural gas distribution pipe).

Changeovers require a new die, new pin, seals for tanks, and half-moons that move the pipe.

Says Leathers, “We can make very thick or thin pipe. HDPE pipe is normally specified by its OD and diameter ratio, or DR – for example 24″ DR7. This means a nominal 24″ IPS outside diameter and a OD/DR ratio of 7. The lower the DR the thicker the pipe, and the more pressure it can take – to satisfy pressures like 100 psi, 200 psi, or 300 psi. The beauty of this product is that the connecting of pipes is just melting them together which is known as a heat fusion process. This creates a continuous pipe with no gaskets. There is nothing to crack or leak, and no cyclical fatigue if pressures change. Among other things, the pipe can also be ‘snaked’ – there is less need for fittings for minor directional changes.”

Managing Production and Building People – Safely

Pipeline Plastics uses a proprietary system which provides executives with a view of the plant performance in real-time. Production schedules, and production metrics can be reviewed at the click of a button, much like navigating spreadsheets. Data being captured includes production data and history, production output (PPH), downtime, and other metrics.

Quality and safety metrics are also part of the production operations system. Mike Leathers is proud of the company’s safety culture, driven largely by organic development of skills and resources. “We try to grow our people from within, “ explains Leathers, “there is significant training and investment in people.” A Step Progression program has been established for employee engagement and empowerment. This program ensures consistent floor training for safety and quality. Additionally, applied automation lessens labor impacts. Ultimately all of these focus points and supporting technology have created an employee culture of safety.

Replacing the Old and Building The Future

There is a bright future on the horizon according to some market figures from 2022. Pipeline Plastics sees over a 2 Billion pound market opportunity for HDPE, with a strong rebound from the Pandemic low of just over 1.6 Billion in 2020. In their view, the largest product segment is conduit which includes data, telephony, some electrical and was nearly 600,000k lbs of pipe in 2022. Some other segments have nice growth forecasts as well:

Oil & Gas pipe has increased nearly 70% since the pandemic. Pipeline Plastics pipe can be used to take frack water to the well site and to remove processed water off the well site. This produced water is collected for reuse many times, or moved by pipelines to disposal wells which eliminates thousands of trucks from roads daily.

2022 was the equal to the highest demand for clean water pipe ever, matching 2017 total.

NGD pipe hit a high in 2022. Industry and mining pipe is growing rapidly due to copper demands and lithium battery demands.

Part of the opportunity manifests through techniques and technology that is being used to replace the aging metal pipes and other older pipes like asbestos cement. A common technology uses a trenchless approach, such as pipe bursting which bursts the old pipe in place and pulls in new HDPE pipe behind it. Another is sliplining and swedging. Swedging is pulling the pipe through a die making it a smaller OD so that is can be pulled through a failing pipe, then releasing the tension – resulting in a new pipeline from the plastic pipe that has been swedged through.

Advancing Technology

A lot of production data capture is still manual entry. Pipeline is looking at the next large investments being sensor data, with more and more real-time feedback. Currently, Leathers says they are doing some sensor data capture and feedback looping as a pilot. Instead of manual entry, every operator would have an iPad that feeds back data to a central system. The data entry would be automated.

Additionally, inner cooling on all the lines that are not coiling – blowing cold air through a coil would be an interesting proposition.

Leathers feels continued improvements of resins and pipe extrusion technologies as well as installations are essential for long term successes building the future now!

Are embedded sensors in the pipe coming? He says possibly, and continues, “A good approach would be embedded RFID technology to be able to detect the pipe more easily – so reliance on as-built data would be lessened and could be tracked above ground more easily.”

No matter what technological advancements are achieved, the right people at every level of the organization that are hired, trained, and retained are essential for real success—having the best pipe makers and leaders all aligned with the same goals. Alignment with vendors, operators, end users, and distributors/customers must also be part of the solution.

Bursting on the Scene

Bursting on the Scene

In his last example of how Pipeline Plastics is replacing aging municipal infrastructure, he said “Our pipe is installed with pipe bursting which is putting a cutter on the front and pulling pipe through while the old pipe is being burst open, typically used for a ductile line that is starting to fail because it is 100 yrs old. The City of Arlington (Texas) recently did this using our pipe to replace some old asbestos cement pipe – and in this situation the nice thing for them is that they didn’t have to bring the asbestos to the surface and worry about environmental contaminants – the pipe can be left in the ground safely encapsulating it in the soil where it is not a danger.”

And that is how the old becomes new again. Right place, right time, right leadership, right product.