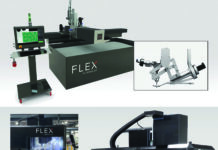

For small- to medium-sized manufacturers that are looking to add to their production capabilities, additive manufacturing (AM) is an option to consider that will literally allow the adding of materials to create parts and products rather than taking them away.

What Is Additive Manufacturing?

Originally developed by MIT, AM adds materials layer by layer to create a 3D object or part. A variety of materials can be used, including plastics, metals, ceramics, or concrete, and the process brings digital flexibility and efficiency to many types of manufacturing operations. AM has been around for about 40 years, and it’s often been called an “emerging” industry.

Analysis of the AM sector showed it had grown to be a $14.5 billion industry with a 22 percent annual growth rate as of 2020, according to McKinsey & Company, a global management consulting firm that serves leading businesses, governments, non-governmental organizations, and not-for-profits.

So, does this mean additive manufacturing has emerged, or is it still emerging? According to Jordan Weston, Director of Education & Conference for the Additive Manufacturing Users Group (AMUG), it depends on who you ask and what industries you are talking about.

“Certain industries have been able to leverage the mass customization capabilities and increased value through freedom of design using AM, such as the medical and dental, and aerospace industries,” Weston says. “But I still think the AM industry is ripe for innovation that will continue to drive adoption.”

In recent years, he says AMUG has seen a lot of development focused on better hardware, software, and materials. More and more, they are starting to see AM considered as a component of the end-to-end manufacturing solution, rather than a standalone tool. Integration between AM machines, raw material handling, post processing, automation, and the production-control systems already in place at factories are necessary to truly bring AM to production at larger scale.

“I believe these are still ‘low hanging fruit’ opportunities, and for that reason, I’d still consider AM an emerging industry,” Weston says.

What Does AM Mean for Small- to Medium-Sized Manufacturers?

When it comes to small-to-medium size manufacturers, he says AMUG is seeing AM adoption on the factory floor with assembly jigs and fixtures, go/no-go gauges, and the robotic end of arm tooling. With the constraints manufacturers are facing with the labor force, time on a 3D printer is typically more accessible than time in the machine shop. He says this translates into AM jigs, fixtures, and manufacturing tools that are a faster, less expensive alternative to machining. Printing these assembly tools offers manufacturers more flexibility in their production and can help lower the barriers to implementing automation.

One challenge or barrier that many small-to-medium size manufacturers often cite is cost. Weston says these manufacturers should understand that 3D printing is another tool in a toolbox, but it does not replace all of the other tools.

“Just because you can 3D print something doesn’t mean that you should. In traditional manufacturing, as complexity increases, so does cost, whereas with 3D printing, complexity is typically negligible,” Weston says. “This opens up opportunities for producing parts that would see pain points with traditional manufacturing – consolidated assemblies, light-weighted designs, or low volume production of complex parts that tooling costs were prohibitive with in traditional manufacturing.”

But he adds that very rarely will additive manufacturing be a simple drop-in replacement for other manufacturing processes, and companies that take a bigger-picture approach to understanding the current design, how it interacts in its assembly, and how additional value can be added to the system are the ones that have the most success implementing 3D printing.

Weston believes AM use-cases will continue to grow, including among small- to medium-sized manufacturers. He says the fact that there has been a focus on better hardware, software, and materials, and the integration of the AM process as an end-to-end manufacturing solution is part of the maturation stage of the AM industry. This will help bring it in line with some of the expectations that the traditional manufacturing industry has already set.

“Additionally, all signs are pointing at the labor shortage being here to stay. As manual laborers continue to get upskilled into higher value positions, lower cost robots and cobots have lowered the barriers for smaller firms to get into automation,” Weston says. These solutions can perform complex tasks and increase manufacturing flexibility, and with each task likely having a need for customized end of arm tooling, the opportunities for AM are immense.

Another current challenge related to manufacturing is supply chain issues. Additive manufacturing is being called in to help in this area as well. Sintavia, LLC, a designer and additive manufacturer of advanced propulsion and thermodynamic systems for the aerospace, defense, and space industry, recently announced that it has been chosen to represent the AM supply chain in the launch of a new government initiative called “AM Forward.”

The compact will focus on building a more resilient and innovative supply chain through investments in small and medium-sized companies that adopt new technologies such as AM. It also aims at helping overcome coordination challenges that limit the adoption of new manufacturing technologies such as AM, and will help develop regional AM ecosystems to enhance domestic production of high-value industrial products.

As the field matures and initiatives such as AM Forward begin to make a difference, more manufacturers transitioning to AM will be critical for expanding its use by industry and allowing small-to-medium size businesses to understand the benefits and adopt AM technologies.

Benefits and Challenges with AM

According to McKinsey, AM technologies offer four potential sources of value when compared with traditional production approaches.

- The ability to generate almost any 3D shape allows designers the freedom to create parts that perform better or cost less than conventional alternatives.

- Since there is no need for molds or fixed tooling, every part produced by a machine can be unique, paving the way for mass-scale customization.

- Eliminating time-consuming toolmaking and fabrication operations accelerates both product development and production, reducing time to market.

- Simplifying the maintenance and support of products in the field reduces the need for spare-parts inventories by enabling on-demand production of items from digital files.

Despite these benefits, manufacturers have cited several barriers to their use of AM, such as the slow speed and limited build volume of AM hardware, the need for vendor-specific software, high-cost materials needed specifically for AM, and cost of additional processing required.

David Ramahi, CEO/President of Optomec, a privately-held, rapidly growing supplier of additive manufacturing systems, says there is no doubt that most companies will experience a prolonged journey to introduce a new manufacturing technology into industry for production.

“The truth of the matter is that there is a very high hurdle to having an established successful manufacturing company transition over to a previously unproven solution, since the performance of their own products is their lifeblood,” Ramahi says. “This situation is exacerbated in the highly regulated markets that AM tends to target; (i.e., aerospace, defense, and medical devices); however, at the same time it is precisely such high-value, lower volume end markets that are most amenable to adopting new technology because in many cases function will outweigh cost, and their end-products have the pricing and margin power needed to absorb any additional cost.”

In parallel with these underlying market dynamics, he adds that there are realities to AM solution development that pose technical, financial, and lead-time challenges. He sees the market development of AM solutions happening in phases, such as:

- Core Technology – the printing process

- Product – the printing equipment

- Ecosystem – ancillary elements, such as materials and post-processing

- Use Cases – the printing application

- Return on Investment (ROI) – the printing value proposition

- Accounts – the early adopters

- Markets – the broader opportunity

“Each of these steps can literally take years to unfold,” Ramahi says. “All that said, Optomec is fortunate to have successfully traveled this path with dozens of blue-chip customers, including GE, Siemens, Raytheon, Honeywell, and Caterpillar, as well as the US Air Force, Navy, and Army, representing a range of applications and markets. We now have more than 600 industrial printers installed, with hundreds of these machines used in daily production resulting in millions of end-products shipped across both 3D metal and 3D electronics applications.”

Keeping the success of Optomec in mind, the journey the company has been on, and lessons he’s learned, Ramahi has several pieces of advice for small-to-medium size manufacturers that might be hesitant to adopt AM or those unsure about embracing it.

“Look for value-add AM opportunities in your current product designs, rather than feeling obligated to leverage AM’s novel geometric and material capabilities in wholly new and radical design paradigms,” he says. He also recommends considering additive repair as an entry point, because it is a high ROI, high throughput application, and it has the added benefit of instilling confidence in the technology. “Adding a little bit of material can add a lot of value,” Ramahi says.

“Seek to replicate others’ successes. There are relatable, real-world production examples from early adopters. Learn from their failures, as well,” he adds. “Don’t wait for comprehensive standards to emerge. They can be mired in bureaucracy for years, letting cost-saving opportunities pass you by.”

Lastly, Ramahi says that there are no shortcuts. Introducing new manufacturing technology will require time and investment, so companies should evaluate the economics at the outset to ensure there is a compelling ROI to make the internal business case.

Conclusion

So, what will the future of AM look like as it continues to emerge? “I think it would benefit from a little less hype, and a lot more execution, especially in terms of delivering demonstrable ROI to production end-users,” Ramahi says. “If we can under-promise and over-deliver, the future will be as bright as our lasers.”

About the Author

Lori Culpepper is a contributing writer for Industrial Machinery Digest based in the Birmingham, Alabama, area. She has more than 16 years of experience writing about a variety of topics for many different industries — especially in the B2B market.