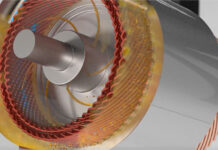

Digital solutions are revamping traditional machinery business models, profit pools and market dynamics (see Figure 1). The shift comes years after digital revolutions overhauled other sectors, but the transformation will be no less profound.

A key indicator of the pace of change is the industry’s voracious consumption of semiconductor chips and Internet of Things (IoT) technology. The industrial sector is now a bigger consumer of chips and IoT technology than any other business sector. And industrial companies’ spending on IoT is growing at a rapid clip (see Figure 2).

The push to develop solutions has prompted leading machinery companies to redefine their markets. Many are developing customer solutions tailored to specific industries instead of producing standard products for a global market. That pivot means focusing on a smaller number of customers in specific vertical industry segments, but it increases the scope of what these leaders can offer those customers—it also means less fragmented supply chains.

For many machinery executives, the shift to digital solutions is the most sweeping change to the industry in a lifetime. However, the payoff is significant for firms that get it right. Digital solutions leaders outperform the industry on total shareholder return by 100%. Customers are seeking these solutions as part of their strategic evolution. Machinery companies that are among the first to meet that demand will generate higher revenue, bigger margins, improved customer loyalty, and software-like valuation multiples (see Figure 3).

The Pitfalls

In our experience, several common errors hinder machinery companies’ efforts to develop digital solutions. The first is failure to clarify the company’s ambition in digital solutions. In short, why invest? As they rush to join the race, many design digital products and services to sell more hardware and equipment instead of solving customer problems. As a result, their solutions are less competitive. Worse, these companies continue to focus on traditional products while rivals reshape the market.

A second pitfall is a lack of focus. One of the biggest challenges leadership teams face in the transition to digital solutions is selecting a few target markets. Companies that engineer digital solutions for a broad market will be overwhelmed by the heterogenous demands of multiple industries. Unable to scale their solutions, they will have to redesign or reengineer solutions from one customer to the next and won’t be profitable.

The Customer Mindset

The Customer Mindset

Leaders scale digital solutions successfully by focusing on two questions: For which customers are we among the most relevant suppliers, and what solutions would solve the problems these customers face? Software companies excel at this customer-centric market approach and it has propelled their success over the past 20 years. Machinery companies that lead the digital solutions shift will do the same over the next two decades.

John Deere, for example, has invested billions of dollars over the past decade to pivot from a tractor manufacturer to a provider of solutions for precision agriculture, including machines combined with digital technology that make farming more efficient. In 2022, the company introduced self-driving tractors and sprayers that distinguish weeds from crops. The company plans to connect 1.5 million machines in service and use its cloud-based operations center to store crop data, hoping to sell farmers subscriptions to software that will help yield higher profit margins.

In our experience, machinery companies that have built successful digital solutions follow five guidelines:

Target a few customer segments. Address customer pain points in select vertical markets. Thermostat maker Danfoss provides solutions to food supermarkets that depend on reliable refrigeration. In addition to selling systems that monitor the temperature of refrigerated storage areas and shelves, the company’s connected thermostats also offer solutions for energy management, usage analytics, and predictive maintenance.

Target a few customer segments. Address customer pain points in select vertical markets. Thermostat maker Danfoss provides solutions to food supermarkets that depend on reliable refrigeration. In addition to selling systems that monitor the temperature of refrigerated storage areas and shelves, the company’s connected thermostats also offer solutions for energy management, usage analytics, and predictive maintenance.

Become a digitalization partner. Digital solutions, such as software, change the way a company works. Software companies use teams of expert advisers to help customers adapt their ways of working and ensure that they get the full benefits of the technology they install. Machinery companies will also need to provide such services.

Embrace customer unit economics. Machinery and equipment companies build business plans based on product unit economics, ensuring that the price of a machine covers the costs of building it. Digital solutions, such as software, require a different approach as the most significant cost is not building the product but acquiring customers. Leading machinery companies create a business case for digital solutions based on customer unit economics, including customer customer acquisition cost and lifetime value. (The bad news: It’s not a fast payback).

Invest in an Engine 2 business. Machinery companies can use organic investments and acquisitions to build a substantial technology-based business to complement hardware sales. Partnerships offer the greatest value in back-end operations (including solution development and delivery). Leaders avoid outsourcing customer-facing parts of the business. The reason is that sector-specific knowledge and customer relations are key in winning sales and retaining core customers.

Use open technology architecture. Digital solutions built on flexible technology architecture have a big advantage in the market: seamless integration and interoperability with leading IT systems and operations technology (OT). Open technology architecture also complies with security standards.

The digital transformation of machinery is well underway. Successful OEMs are forging deeper relationships with their best industrial customers and developing solutions for the industry segments in which they are a leader. Future winners will scale solutions that can be used repeatedly in the same sector with minor adaptations from one customer to the next. As that process accelerates, it will change the competitive boundaries of the industry: Future markets will be defined by customer segments, not products. In this new era, machinery companies that have scaled digital solutions for a targeted set of customers will have a competitive advantage that is difficult to challenge.

By Adrien Bron and Neil Malik

About the Authors

Adrien Bron and Neil Malik are partners in Bain & Company’s Advanced Manufacturing and Services practice.