In 2017 the combined reshoring and related foreign direct investment (FDI) announcements surged, adding over 171,000 jobs in 2017, with an additional 67,000 in revisions to the years 2010 through 2016. This brings the total number of manufacturing jobs brought to the U.S. from offshore to over 576,000 since the manufacturing employment low of 2010. The 171,000 reshoring and FDI job announcements equal 90% of the 189,000 total manufacturing jobs added in 2017.

In 2017 announcements of combined Reshoring and FDI jobs were up 122% compared to unrevised 2016 totals and 52% compared to revised 2016 totals. We believe the huge increases were largely based on anticipation of greater U.S. competitiveness due to expected corporate tax and regulatory cuts following the 2016 election. Similar to the previous few years, FDI continued to exceed reshoring in terms of total jobs added, but reshoring has closed most of the gap since 2015.

Reshoring and imports both increased in 2017

Progress is, however, relative. Reshoring and imports both increased strongly in 2017. In 2015 we determined that parity was reached between offshoring (calculated from any increase in imports) and returning jobs, indicating that the net bleeding of manufacturing jobs to offshore had stopped. In 2016, for the first time since the 1970, we reshored more jobs than we lost to offshoring. The U.S. had gone from losing net about 220,000 manufacturing jobs per year at the beginning of the last decade, to adding net 30,000 jobs in 2016.

When measured by our trade deficit of about $500 billion/year, there are still three to four million U.S. manufacturing jobs offshore at current levels of U.S. productivity, representing a huge potential for U.S. economic growth. Measured by our $700 billion non-petroleum goods trade deficit there are about five million still offshore.

When measured by our trade deficit of about $500 billion/year, there are still three to four million U.S. manufacturing jobs offshore at current levels of U.S. productivity, representing a huge potential for U.S. economic growth. Measured by our $700 billion non-petroleum goods trade deficit there are about five million still offshore.

Reshoring + FDI by Industry

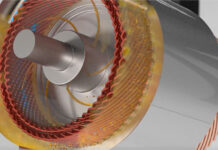

Only products that have been offshored/imported can be reshored. Thus, the products least suitable for offshoring never left, such as heavy, high volume minerals, high mix/low volume items or customized automation systems.

The most active reshoring is by those that left and probably should not have done so, including machinery, transportation equipment and appliances. Reshoring is focused on products whose size and weight, e.g. transportation equipment, or frequency of design change/volatility of demand, e.g. fashionable apparel or customized tooling, suggest that offshoring never offered great total cost savings.

FDI is more heavily weighted towards transportation equipment because of the ongoing investment in automotive assembly plants and related suppliers. FDI also benefits the most from government incentives.>

Major Macro-Economic Impact

Based on their huge surge since 2010, reshoring plus FDI are now having a major macro-economic impact. This data should motivate companies to reevaluate their sourcing and siting decisions and make better decisions that consider all of the cost, risk and strategic impacts flowing from those decisions.