Simulation software is an essential tool in modern manufacturing automation, enabling manufacturers to model, test, and optimize processes in a virtual environment before physical implementation. It can be used to design and test robotic movements, assess production-line efficiency, and model complex interactions among machinery, materials, and operators. It plays a key role in the development of new systems and the ongoing optimization of existing ones — in both greenfield planning and brownfield redesigns.

Simulation has traditionally been used across all stages of design, from early capital expenditure (capex) planning to production routing optimization. That’s still the case today, but simulation models have recently made their way into production planning processes. “We take a simulation model of our production environment and run the order forecast through a few scenarios to make better decisions around worker allocation, WIP [work in progress] strategies and quantities, and even planned downtime for equipment,” says Michael Sarvo, digital design business development manager for Rockwell Automation. “This is a winning strategy because you can improve your reaction time to constantly changing conditions.”

Simulation differentiates the early adopters from the laggards within various segments and industries, says Iiro Esko, industry manager and digital transformation architect for Siemens Digital Industries. “You use simulation through optimization, training, commissioning, acceptance testing, engineering, and in connection with procurement and sustainability planning,” he says.

The State of Simulation

While some top-level manufacturers understand the benefits that simulation software offers, not everybody is on board yet. “There’s a massive spectrum of adoption and tech level out there,” Sarvo says. “Some companies are all in and have made simulation and related practices an integral part of how they do business, while others still don’t see how this kind of technology could possibly be a benefit.”

There are many different types of simulation software, as well as different ways to classify it, notes Ravi Aglave, director for chemical and process industry at Siemens. Control simulation, for example, relates to how you can achieve control of any given process. Molecular-scale simulation illustrates how materials will behave at a molecular level. Structural simulation provides insights into how the structure of a building or a car or an airplane might behave or respond.

Simulation can be defined by its scale — anywhere from molecular to the whole plant — or by the depth of understanding it provides. Before considering simulation software, manufacturers first need to understand what they want to get out of it. Is it to optimize costs, quality, or system operation, or to increase profitability? Simulation in automation addresses all of the above: It reduces costs by minimizing trial and error in physical setups, enhances flexibility by allowing rapid adjustments to system designs, and improves product quality through refined control over manufacturing processes.

Sarvo explains the benefits simply: “Simulation tools provide a more efficient and more accurate means of predicting the future. When you have better and earlier predictions, you have more opportunity to plan, design, and execute, resulting in better outcomes.”

At Rockwell Automation’s Emulate3D User Group Meeting in October, integrator Automation Intelligence explained how it used simulation software to help the second largest distributor of beer, wine, and spirits understand whether it could add 20% new volume without constructing another building.

Republic National Distributing Company (RNDC) handles more than three million cases per year at its distribution center in Morgan Hill, California. But the company faced challenges due to labor shortages, growing demand, new material handling equipment, and resource allocation within a multilevel pick module. The strategy was to replace manual processes and storage areas with high-tech automation and control systems. But such significant upgrades bring their own risks.

“Think about it — you must shut down existing production, install new, unfamiliar systems, and train engineers, operators, and maintenance personnel,” Sarvo says. RNDC used Emulate3D to model its production environment to understand how the new automation could be used to meet production demands. “Because of the way Emulate3D software works, they were also able to test and debug their new control systems against the model before the real system was built, and they were able to train their people on the new processes and equipment, so they were ready for production as soon as the new system was online.”

In production, RNDC continues to use the hybrid simulation/digital twin models to run forecast data and optimize daily production schedules.

How the Digital Twin Fits In

At its core, simulation software creates digital twins of production systems, machines, and workflows, allowing manufacturers to explore a wide range of scenarios without the cost and risk of real-world experimentation.

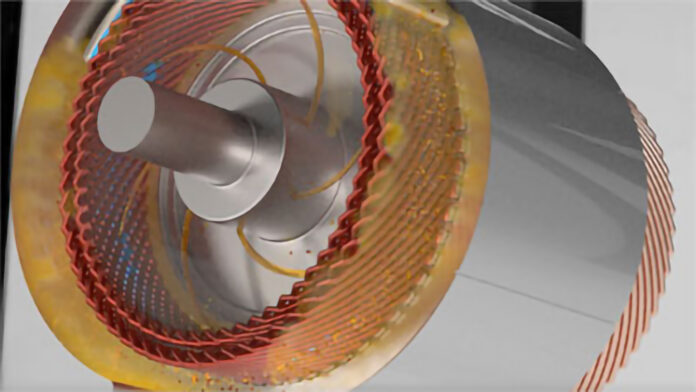

For Siemens, a digital twin is the digital representation of theoretically all different types of simulation, says Andrea Sassetti, innovation manager, Siemens Digital Enterprise Lab at MxD. “We are able to cover many different aspects — molecular fluid dynamics, mechanic, kinematic — and also simulate a sensor and see how it performs in a digital space,” he explains. “All those types of things are possible using simulation tools that are capable of converting the simulated activity for the behavior of standard equipment or device or valve or motor in a digital point of view.”

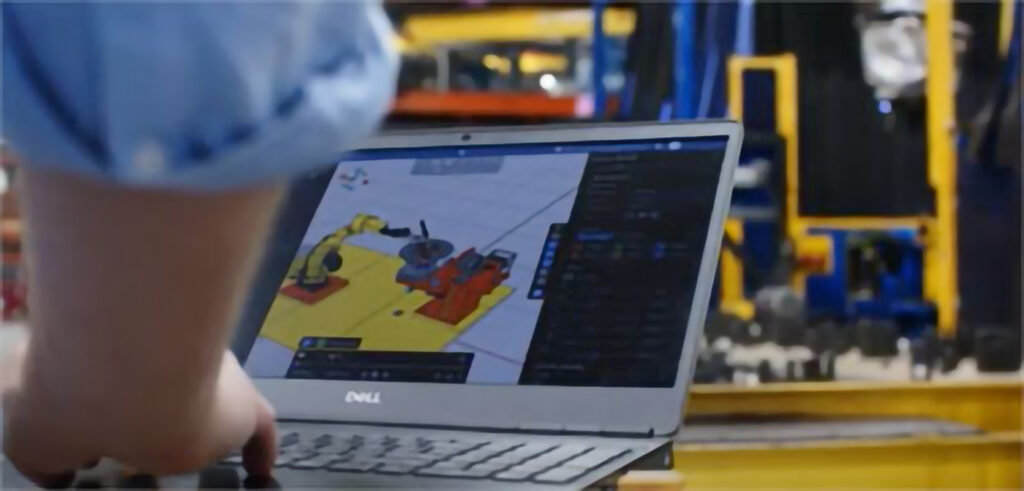

In partnership with the U.S. Department of Defense, MxD in Chicago is an ecosystem designed to solve critical manufacturing challenges. There, the Siemens Digital Enterprise Lab provides a live mock manufacturing environment to demonstrate Industry 4.0 technologies with the merging of virtual and physical worlds.

At MxD, Siemens partnered with collaborative robot (cobot) manufacturer Universal Robots (UR) to create a palletizing cell, for example, to simulate the robot. “We are able to simulate all the behavior of the equipment — pick the parts, drop on the pallet, open and close the gripper, and do many cycles based on position,” Sassetti says. “All these types of things can be done before purchasing the hardware, including the metal, the PLC, and the end effector.”

The UR simulations are also concerned with safety, Sassetti adds. They can simulate what the cobot will do when next to a human operator and determine where in the process it’s necessary to slow down or even activate the emergency stop.

Hirata, a Japanese system manufacturer that supplies transmission and engine assembly lines and electric vehicle and other automotive production equipment to numerous manufacturers, uses Siemens’ Process Simulate as part of a broad digital transformation initiative. With it, the company has been able to shorten the time it takes to go from product design to manufacturing.

Previously, Hirata required three engineers working 3–10 days to complete equipment validation. Using Process Simulate for 3D model validation, Hirata has reduced workforce hours by 90% and human-hour requirements by 66%.

Hirata has also used digital simulation tools to teach its robots offline. “Previously, we had to turn on the power, start up the robots, and then perform the teaching work to check for interferences, cable twists, and other issues,” says Shoichiro Seki, general manager of the engineering departments at Hirata. “Now all of that can be performed offline, which is incredibly helpful for manufacturing.”

Offline Robot Programming

As a subsector of simulation software, offline robot programming (OLRP) can greatly benefit how integrators and manufacturers program, deploy, and reprogram their robots by eliminating the need to interrupt productivity.

Octopuz, which focuses specifically on the OLRP sector, says the software is just finding its footing in the general manufacturing market. As opposed to factory simulation software, which simulates how parts move through production, for example, and figures out bottlenecks, OLRP takes a much more focused view by creating production code that can be used in the real world.

The top application for Octopuz’ OLRP offering is robotic welding. “Rather than programming the robot by standing in front of it with a teach pendant to do all the things needed to do a weld, you’re going to use software like Octopuz to do all that programming in a virtual environment,” says James Schnarr, senior product manager at Octopuz. “[Users] can make sure that the program is free of errors — so the robot’s not going to have errors and there’s not going to be any collisions. And then we actually produce the robot code at the end of it. They bring it to their robot, and it’s ready to run exactly as they expected it to based on what they designed in our software.”

A key benefit to using OLRP as opposed to a teach pendant is to eliminate robot downtime. Typically, a user programs a robot to do one task. If the job changes, the time it takes to program the robot for a new task or product is time that the robot is not working.

That’s in part why robotic welding is a particularly important OLRP application. In robotic welding, changing one part can mean reprogramming 100 different welds. “If I’m standing in front of the robot with the teach pendant, I’m doing two things: I’m taking a long time to program those 100 welds, as I manually jog the robot through each of those welds and do the programming, but I’m also taking the robot off production,” Schnarr says. “That might take a day, it might take five days, it might take three weeks, depending on the complexity of the welds and of the programming. And if my robot’s getting programmed, then it’s not running production.”

Conversely, with OLRP, the robot can be performing its initial weld job while the software is running on the computer. When the manufacturer is ready for the robot to move to the next job, the code is ready as well. “I might do some touch-ups, but I’m going to be ready to go with production in a few hours, maybe a day, as opposed to multiple days or weeks,” Schnarr says.

Aside from welding, applications that benefit from simulation software are other high-mix, low-volume operations, such as a fab shop performing contract work for several different customers.

Jomar Machining & Fabricating in Middlebury, Indiana, manufactures tire shredding equipment used for recycling tires. The company employs robots for hardfacing — the type of welds that most humans don’t like to do, says Lyndon Schlabach, robot programmer for Jomar, who also oversees the company’s welding operations.

“We had one robot that I was programming before we bought Octopuz. We were stopping the robot for a week straight just to do programming on a part,” Schlabach says. “With Octopuz, we can program the robots while they’re in production.”

Jomar has also found that the robots programmed offline produce better-quality welds. “On a surface weld, like we’re doing, to try to manually program all these paths and make them so they line up correctly to get a good even weld, it took a lot of time,” Schlabach says, adding that parts made by the Octopuz-programmed robots last longer in the field.

Artificial Intelligence and the Industrial Metaverse

Simulation continues to evolve. “Today, the kind of simulation that you can run is probably a trillion times what you could do maybe 10 or 15 or 20 years ago,” Aglave says. “There are two parallel advances that are happening. One is the computing power itself, and the other is the understanding of the behavior of objects and systems — the physics behind it.”

As with many other manufacturing technologies, artificial intelligence (AI) is likely to speed the progress of simulation capabilities. “It only makes sense that we’ll see artificial intelligence integrations of all kinds,” Sarvo says. “People are certainly using AI decision-making algorithms. There are APIs [application programming interfaces] for that sort of thing, and powerful simulation tools provide open scripting environments where users can extend the software’s functionality as they like.”

AI is also gaining momentum to create simulations that are a hybrid between physics- and data-based models. “The second thing that will be gaining momentum would essentially be how to take a large simulation and reduce it down into a simpler behavioral model for controlling the manufacturing operations,” Aglave says, referring to this as an executable digital twin. “The simulation essentially acts as a distilled, intelligent brain that can be used to ask questions and immediately get answers to make changes to the manufacturing operations.”

Combining AI with digital twins creates an industrial metaverse. “The next level of the digital twin is the industrial metaverse because it’s a place where we are leveraging the real data in combination with the digital twin, as well as the AI that is running behind the scenes in order to validate what is happening in the plant,” Sassetti explains. “It’s a live environment where you are able to test new possible solution improvements.”

By: Aaron Hand, TECH B2B, A3 Contributing Editor