Cross-Border Moves: In the Face of Uncertainty

Border towns, such as El Paso, Texas, could service as “middle ground” if OEMs with operations in Mexico decide to relocate stateside

Border towns, such as El Paso, Texas, could service as “middle ground” if OEMs with operations in Mexico decide to relocate stateside

For OEMs that rely on the Maquiladora industry in Mexico, such as the automotive, electronics and medical device industries, the threat of increased tariffs on imports as high as 35 percent has created considerable uncertainty. Factor in the possibility that such a move could spark a trade war and OEMS are rightfully concerned, with many considering their options to keep prices on finished products at a competitive level.

Much remains to be learned, of course, as to exactly what trade restrictions will be enacted by the new administration. What is sure, is that any significant increase in the cost of goods from Mexico will leave US companies that rely on lower-cost labor to keep prices competitive with a tough decision.

Among the options, maintaining existing operations in Mexico and likely raising the price of the finished product, or relocating stateside. For the latter, this could mean a full move back, or a small cross-border move to cities already in tight working relationship with Mexican counterparts and the supply chain infrastructure.

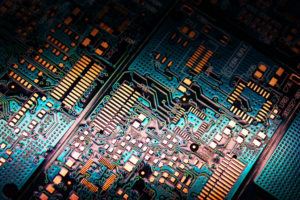

“Companies will have to consider their options and bridge the gap between what their cost will be to remain [in Mexico] and the cost to relocate back to the U.S.,” says Hector Macias, director of Northpoint Technologies, a US-based company that manufactures silicon and membrane switches, flexible PCBs and assemblies, touchscreens and wire harnesses for the medical, automotive, defense, telecommunications, industrial and consumer markets.

Macias estimates that the fully-burdened labor costs, which include taxes, benefits and supplies, in Mexico is approximately $3.25-$3.50, compared to $10.25-$10.50 in the U.S. This does not account for valuable incentive packages provided by the Mexican government in the form of tax breaks, land and infrastructure.

“There is already quite a gap in cost, so companies may not even move,” says Macias. “Instead, they may opt to increase the costs of the finished product to absorb some of the additional costs.”

If this occurs, it will inevitably become a case of “the consumer always pays” as the cost of consumer products such as cars, flat-screen TVs and home appliances rise.

“To me the biggest hurdle of any restructuring of NAFTA is going to be to convince consumers to pay 25% more for the same model of microwave that is now made in the U.S. instead of Mexico,” adds Macias.

In many ways, Macias is literally at the virtual epicenter of this issue. In the past 35 years, he has been involved in over 300 transfers of either production lines or plants into Mexico from US based companies.

He now operates El Paso, Texas-based Northpoint Technologies, a third-party supplier of turnkey electronic subassemblies, many of which involve labor-intensive assembly.

According to Macias, his company has been able to offer competitive pricing on these subassemblies, in part because of its geographic location and ability to price from different low labor cost regions. This includes light and high volume assembly in Mexico and in Asia.

Cross border relocation

Even if manufacturers decide to relocate operations back to the United States, a full move back to a location thousands of miles from Mexico may not be viable.

Another option could be relocating a plant just north of the border. This would allow OEMs to take advantage of the existing supply chain, expertise and even labor force with little disruption.

As it stands, industrial border towns such as El Paso already work in a symbiotic relationship with the Maquiladora industry.

El Paso stands across the border from Ciudad Juárez, Chihuahua, Mexico. With more than 1,100 manufacturing operations in the region, it boasts one of the largest bilingual, binational work forces in the western hemisphere.

The city already serves as the coordination point for logistics and receipt of raw materials into Mexico. Key personnel and much of the workforce live in El Paso and travel back and forth over the border daily.

“Being in El Paso, we are strategically located to help relocate manufacturing on this side of the border if needed,” says Macias. “Everything that is going into Mexico right now is kept in staging warehouses here in El Paso, so it’s already there. The raw material does not have to enter into Mexico, it can stop here for assembly.”

El Paso also has some of the lowest wage requirements in the United States, operating at the nationwide minimum $7.25 per hour. While higher than labor in Mexico, 29 other states, including California, already mandate wages above the federal minimum.

As a case in point, wire, cable and wire harnesses are labor-intensive, with much of the work requiring manual assembly using fixtures and jigs. Little, if any, of the process beyond can be automated.

For high volumes, wire harnesses are typically assembled in Mexico or other low-wage countries. Macias has prior experience in the wire harness industry in Mexico for a company that produced $300 million per year in product.

For lower volume, custom work, much of the wire harness work remains in the U.S. at facilities like Northpoint Technologies. These wire harnesses are typically aftermarket products used in industrial equipment, such as forklifts.

Given the existing infrastructure and supply chain, ramping up operations to deliver larger volumes in El Paso could be achieved with minimal increase in costs.

Move to Asia?

In recent decades, the other alternative to Mexico was to move operations or source products from Asia. However, with the new administration stance toward China, the prospect of tariffs or a trade war seems even more likely.

At the same time, labor rates continue to increase at the rate of 15-20% a year, removing some of the allure of turning to Asia. Mexican wages, on the other hand, have been more  stable.

stable.

In Asia it can also be very difficult to manage operations. For example, many OEMs that contract directly with offshore suppliers experience communication difficulties that can lead to errors with subassembly materials or dimensions, avoidable logistical difficulties, or even cost miscalculations.

Uncertain Future

Although the extent of new trade regulations or tariffs is not yet known, proactive OEMs would be wise to consider the options.

Failure to do so could leave US companies at a competitive disadvantage both at home, due to escalating prices on goods, and in competition with other global manufacturers that also manufacture or source products from Mexico.

For information contact: Northpoint Technologies, Inc.; 13321 Tobacco Rd., El Paso, TX 79938; Phone: (915) 591-6300; Sales Office: (800) 553-5087; Email: sales@northpoint.com; Visit the web site northpointech.com